It is a privilege to write about the persecuted church, who are true Christians, and one I certainly do not deserve. I feel that this should be done by someone holy, which I am not. I am an ordinary sinner. Their stories of great persecution and of great faith often reduce me to tears and make me more aware of how much I take my religious freedoms for granted and how undeserving I am of God’s tremendous grace and love.

I desperately want to help them. I would like to reach through my computer screen and lift them out of their misery and restore them in every possible way. On a tangible level, I am limited to giving what I can. I encourage everyone to give generously to the persecuted church. Our brothers and sisters often sacrifice everything to follow Jesus Christ, and they need our help. As Christians know though, our power is really in our prayers and petitions to our God. It is in my prayers for them, which are the most frequent and the most intense of all my prayers, that my hope ultimately resides. I would like the Lord to hear these above all others, hear his people’s tears and suffering, and with his powerful hand do what I cannot.

Christ Suffered, True Christians Also Suffer

When Christians pray, we often ask for many things. We ask to be granted various forms of aid and to be relieved of suffering for ourselves and for others. This is quite understandable, and we should continue to do so. However, we also need to remember that the story for Christians is the story of Christ, and his story is one of suffering. Jesus died a brutal death, executed by crucifixion under false charges. It was also a death he freely accepted. We can remember his journey and allow his tremendous sacrifice, which is our salvation, to also be our comfort as we endure our own trials and tribulations.

“I Have Chosen You Out of the World”

The following words applied to Jesus’s disciples then and still apply to the persecuted church throughout the world today. Jesus said, “If the world hates you, realize that it hated me first. If you belonged to the world, the world would love you its own; but because you do not belong to the world, and I have chosen you out of the world, the world hates you…. And they will do all these things to you on account of my name, because they do not know the one who sent me.” (John 15:18-19, 21)

A Story of a True Christian

There are so many stories of persecution that deserve our attention, and they span the globe, from the Middle East to Asia to Africa to South America. To highlight one story, there is nothing more painful for a parent than to lose his or her child. As shared by Christopher Summers with Open Doors (2019), Neelesh’s 7-year-old Christian son was beaten to death by Buddhist boys at his boarding school in India.

After his death, his depressed father resorted to alcohol to self-medicate and, on one occasion, ran into his former pastor. “Gazing right into my eyes, he said, ‘Neelesh, do you want to meet your son?’ I was so very angry. I said, ‘Are you mocking me? You know he is long dead!’ To my astonishment, the pastor replied gently, ‘If you drink like this and leave Jesus, you will never meet your boy, who is now in heaven.’

‘His answer shook me to the core. Here was the truth! My son was just seven when he died, but he loved Jesus. He sang hymns wholeheartedly whenever I led in worship. My martyred son is surely in heaven. I would never see him if I left Jesus.

‘That night I had a vision. I saw my son playing in a beautiful garden. As I went towards him he stopped me and said, “Dad, you should not come here now. It is not yet your time. See, I am very happy here.”’

Neelesh says that after that night he felt an extraordinary peace in his heart. He comforted his wife and restarted his ministry. ‘It was as if God had revived me totally,’ he says. ‘I moved on with more faith and zeal than ever and have been continuing still.’”

Christians who are born again can often point to a moment when grace penetrated their heart, mind and soul and soon thereafter redirected their lives to fulfill God’s will. This is not to suggest that they magically transform into a different person or that they experience no doubts or spiritual setbacks afterwards but that their faith becomes solidified in a way it had not been before and that they gain renewed clarity and purpose for their lives.

The truth of Neelesh’s life is that his suffering, the loss of his only son because he followed Jesus, could have made him a bitter man, but instead he became a better man and a better Christian through grace. This is what it means to be a Christian.

Desecration of Christians’ Sacred Symbols

It feels almost sacrilegious to write of the holy and the unholy in the same post, but it is important to place them next to each other to see the obvious contrast of true Christians with devil worshippers. It is easy to hold the Bible high, and we recently witnessed this profanity by the dear leader of the devil worshippers, the supposed president of the United States. This sacrilegious act made headlines for all the wrong reasons, yet it was defended by certain people of whom we will speak shortly.

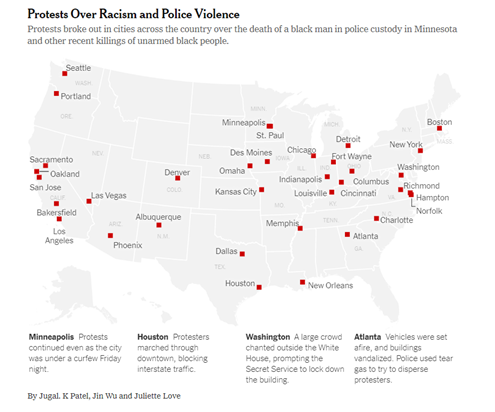

Mariann Budde, the bishop of the Episcopal Diocese of Washington, wrote on June 4, 2020, “I was outraged by…Trump’s use of the Bible and the backdrop of St. John’s Church for his political purposes. I was horrified to learn that while he was threatening to use military force across America, peaceful protesters were being forcibly removed from Lafayette Park so that he might pose before the church for a photograph. I wasn’t alone. My phone lit up with messages from people across the country who, like me, couldn’t believe what we were seeing. But if we keep the focus of our outrage there, we allow ourselves to be distracted from the issues that are compelling Americans to take to the streets in large numbers. I wonder if that’s the intention.”

Indeed, the nation is wondering a good many things. Predominant among them should be: how did we get here, where a satanic cult leader is also the leader of the free world? Perhaps the most important reason is: the “Christian right.”

The Opposite of Christians – Devil Worshippers

The Gospel Coalition recently wrote a piece on QAnon, which they described as a satanic cult. Carter (May 20, 2020) wrote, “As Adrienne LaFrance writes, ‘To look at QAnon is to see not just a conspiracy theory but the birth of a new religion.’” Indeed. That new religion is a satanic cult that bears no resemblance to Christianity. Carter follows with, “(…Trump has frequently retweeted QAnon-related accounts on Twitter, and some parenting and lifestyle ‘influencers’ promote the views on Instagram, YouTube, and Facebook.) Although it’s still on the fringe, Christians should be aware of the threat this political cult poses to the global church.”

What The Gospel Coalition and Carter should have said is that they are actually describing the “Christian right,” i.e. self-proclaimed “Christian conservatives,” although there is nothing either Christian or conservative about them, and that QAnon is just a more extreme expression of the very ideas and the culture that is mainstream in their churches. The “Christian conservatives” will take great umbrage at this characterization and protest (of course, they doth protest too much), but it is an accurate description.

As just one example, Eric Martin (August 2020) wrote, “One of the alt-right’s biggest political influences is former presidential candidate Pat Buchanan, communications director under Ronald Reagan. He and fellow Catholic Joe Sobran served as inspiration for a blog referred to as ‘the alt-right’s favorite philosophy instructor,’ and his comments on immigration and questioning the Holocaust are the type of kinder, gentler white nationalism that provides oxygen for the more obvious forms. Buchanan has claimed that Jews hold the ‘real power’ in the U.S., that not as many died in the Holocaust as reported, and that ‘this has been a country built, basically, by white folks.’ When an interviewer suggested that white people had held power in the U.S. for years, Buchanan bristled. ‘I don’t know where you grew up,’ he retorted. ‘I grew up in a Catholic ghetto.'”

As another example, Franklin Graham is the son of Billy Graham, and he has inherited a legacy he does not deserve. What was the supposed high priest of the “Christian right’s” reaction to the repugnant desecration of a church? Franklin Graham took to Facebook with the following message, “President Donald J. Trump made a statement by walking through Lafayette Park to St. John’s Episcopal Church that had been vandalized and partially burned Sunday night. He surprised those following him by holding up a Bible in front of the church. Thank you President Trump. God and His Word are the only hope for our nation.” What would compel Franklin Graham to defend the indefensible?

Simple. Franklin Graham does not worship Jesus Christ. He worships himself and Donald Trump. He is power hungry. Similarly, Eric Metaxas does not worship Jesus Christ. He worships himself and Donald Trump. He is a careerist. Another, Jerry Falwell, Jr. does not worship Jesus Christ. He worships himself and Donald Trump. He is an opportunist. The list goes on. They worship false gods. They are devil worshipers since they all worship Donald Trump. They are not Christians, and they need to stop claiming to be Christians. Do not be led astray by these pretenders, these worshippers of false gods.

Christians’ One True God

Let us return to our one true God. Jesus fulfills the word, and what he said of the unbelievers who knew Moses’s laws and words and could recite them quite well but never understood their meaning still applies today to other self-proclaimed “believers.” Jesus said, “’I do not accept human praise; moreover, I know that you do not have the love of God in you. I came in the name of my Father, but you do not accept me; yet if another comes in his own name, you will accept him. How can you believe, when you accept praise from one another and do not seek the praise that comes from the only God?” (John 5:41-44)

The false prophets do not love Jesus or the Father, and they do not have the love of God in them. We know this because if they did, it would show clearly to the rest of us. Instead, when we hear them or see them, we cannot see Jesus because he is not there. Jesus is one of the most loved and admired figures in the world. Even those who do not believe in his divinity can see his goodness because it is clear who Jesus loves. He loves the Father and us. He is one with the Father, and every word he spoke and every action he took reflected who he was and who he loved.

When in the garden at Gethsemane, Jesus says, “Father, if you are willing, take this cup away from me; still, not my will but yours be done.” (Luke 22:42) This is what real love of God looks like, and it is also obvious in the persecuted church. Do not mistake false prophets for men of God. Men of god love God; they seek his praise and his love; they seek to do his will. In Neelesh, we can see Jesus. Summers writes, “The anguish of losing his son has not passed—and never will—but the hope has returned. ‘I have made up my mind now,’ Neelesh says. ‘I will live for Christ and if He wants, I will die for him. Because what I lose for Him, I will actually gain in the end.’”

Martin Luther King, Jr.

In Martin Luther King, Jr., we can see Jesus. In his famous, I’ve Been to the Mountaintop speech, he said, “All we say to America is be true to what you said on paper…. Somewhere I read of the freedom of assembly. Somewhere I read of the freedom of speech. Somewhere I read of the freedom of press. Somewhere I read that the greatness of America is the right to protest for rights….

We’ve got some difficult days ahead, but it really doesn’t matter with me now because I have been to the mountaintop. And I don’t mind. Like anybody, I would like to live a long life. Longevity has its place, but I’m not concerned about that now. I just want to do God’s will, and he’s allowed me to go up to the mountain. And I’ve looked over, and I’ve seen the Promised Land. I may not get there with you, but I want you to know tonight that we as a people will get to the Promised Land. So, I’m happy tonight. I’m not worried about anything. I’m not fearing any man. Mine eyes have seen the glory of the coming of the Lord.” He was assassinated the next day.

The “Christian Right” Are Not Christians

Instead, what do people see when they look at the “Christian right”? Nothing holy and nothing resembling Jesus. There are so many damning statements. I am surely missing some of the most biting, but here is a sampling nonetheless.

You get the idea. It is like trying to escape one’s racist past while still being racist in the present. No amount of cute marketing gimmicks, such as “weird [insert denomination or denomination] Twitter,” can change that.

The Satanic Cult Leader

Christianity Today’s retired editor in chief Mark Galli (December 2019) wrote a powerful statement regarding Trump’s impeachment, in which he declared that Trump should be removed from the office because of his character weaknesses and his conduct. Galli’s statement took courage, and he deserves credit for it. However, you know what else was powerful? The backlash against it from white evangelicals and other “Christian conservatives.”

More recently, Christianity Today published a piece that wholly lacked Galli’s moral clarity. Jayson Casper (June 30, 2020) wrote, “… ‘Trump’s executive order will make the commitment to international religious freedom more robust,’ said former congressman Frank Wolf, arguing the Trump administration has been markedly stronger on the issue than those of either party. ‘If you care about religious freedom, this is an issue to vote on.’”

Indeed, if you care about religious freedom, it is an issue to vote on, but it would be decidedly against Trump, the man who gave the green light to Xi’s concentration camp for Uighurs, in which all manner of evil occurs including rape. Religious freedom means religious freedom for all, not just for Christians.

What Christianity and Christians Look Like

While the “Christian right” morally contorts themselves into pretzels to avoid what is clearly a difficult choice for them between Jesus and Trump, the persecuted church has no such difficulties. They, like Martin Luther King, Jr., like the recently deceased John Lewis, like Elijah Cummings, like so many good Christian men and women around the world choose Christ over everything including themselves. That is love for and faith in our Lord, Jesus Christ. That is what Christianity and true Christians look like. Do not be deceived by anything or anybody else. Look for the Lord in those who claim to be Christian and if you cannot find Jesus, you could very well be looking at the devil in disguise.